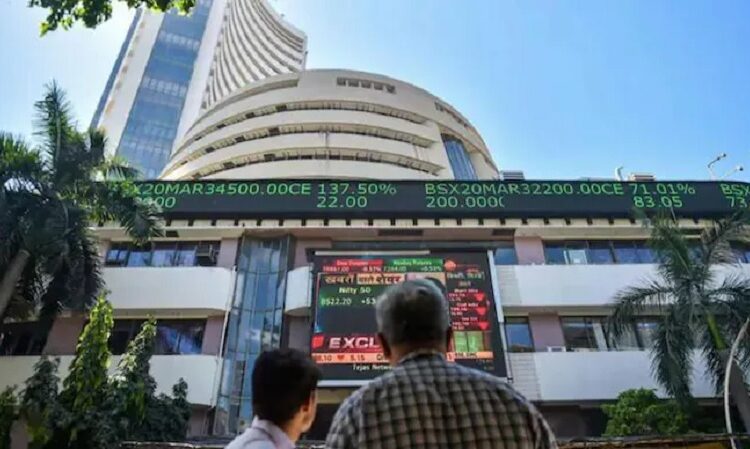

The stock market is one of the most dynamic and constantly changing industries. People invest their hard-earned money to make a profit in the stock market, whether in the short or the long term. Any market is subject to holidays, including the stock market. Stock market holidays occur when an exchange is closed or reduces trading hours. This blog post will walk you through the importance of staying on top of share market holidays. It will also show you how to plan for them to stay ahead of the game.

Understanding Share Market Holidays

A share market holiday is a day when the exchange is closed, and trading is suspended. These holidays can vary from country to country, and many markets may be closed on different days. The share market holidays are scheduled days off from business outside of regular trading and exchange hours.

Why are the Share Market Holidays Important?

Share market holidays are significant events in the trading world. They are unavoidable, but they can cause a significant impact on investing and trading activities. Knowing when holidays occur can help investors and traders prepare for the market’s ups and downs. Planning a strategy around share market holidays can help mitigate risks associated with holiday-related trading volume and price fluctuations.

Planning for the Share Market Holidays

Share market holidays can make it difficult to quickly buy or sell securities. Investors and traders must plan ahead of holidays to ensure they can take advantage of the right opportunities in the market. By planning for share market holidays, it is possible to prepare for short-term fluctuations and long-term trends. Proper planning can help traders avoid unwanted losses and capitalize on the right opportunities as they arise.

Creating a Share Market Holiday Calendar

Creating a share market holiday calendar is critical for those who trade frequently. This will help them stay updated with the latest holidays and plan trades and investments. By looking ahead to the calendar of holidays, traders can plan new investments, balance their portfolios, sell off assets, and move to alternative investments when there is a lack of liquidity in a given market.

Preparing for the Share Market Holidays

Before share market holidays occur, traders should ensure adequate liquidity in the market. Fewer market participants can lead to an increase in bid-ask spreads and, as a result, put traders at risk of absorbing additional costs when buying or selling assets. Traders need to prepare for this risk ahead of time, by evaluating their exposure to thinly traded markets and building contingency plans for trading such assets when the market is more open.

Evaluating Electronic Trading Alternatives

With advancements in technology, traders now have numerous electronic platforms to trade on during the share market holidays. Alternative trading systems may offer reduced costs and easier trading access. While such systems may have their own risks and drawbacks, they can be a strong alternative to traditional stock exchanges during volatile market periods.

Conclusion

In conclusion, share market holidays can bring potential volatility and uncertainty to the stock market. However, with careful planning and preparation, traders can take advantage of market holiday opportunities. It is important to stay ahead of the game to capitalize on investment opportunities, avoid unexpected losses and minimize risks. By creating a share market holiday calendar, ensuring liquidity, and exploring electronic alternatives, traders can stay in control in otherwise unpredictable market environments.