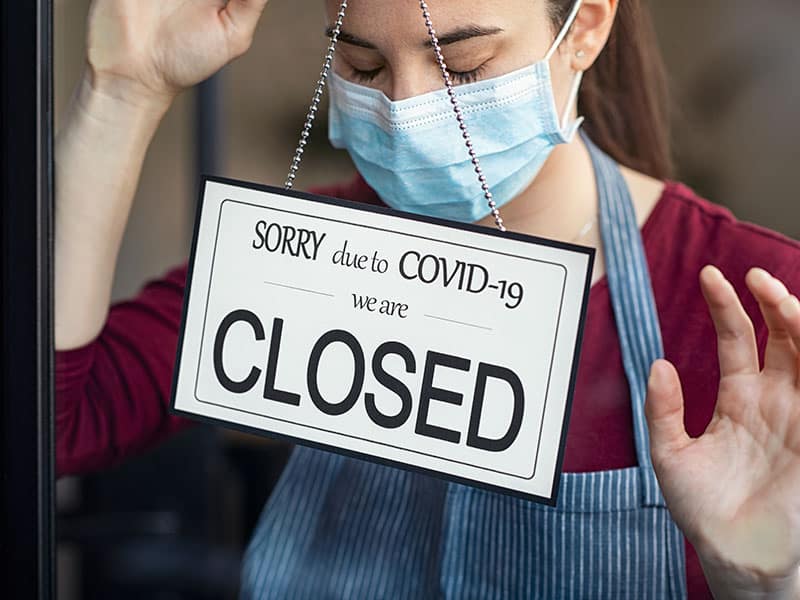

When you realize that bankruptcy may be the finest choice, it may be discouraging to consider the extended-term effects you’ll have to face once you are resolved. Many individuals see daily their bankruptcy as something they never need to do again, however a predicament they learned from. After coping with your debt in this manner, you’ll unquestionably gain understanding that will help you later on or even help all your family people steer apparent in the struggles you’ve been through.

Budgeting

Budgeting will take part in your own bankruptcy situation and could become natural after your obligations are taken proper proper proper care of. A Person bankruptcy Attorney might help since they discuss your conditions they might see the easiest method to strengthen your conditions, you’ll leave through an extensive set of tasks and documents to accomplish. The following factor before filing your conditions, you’ll have to possess a web-based Cccs Course. These kinds won’t allow you to see whether bankruptcy may be the solution you are looking for, however a big focus in the class can also be on budgeting. Another, publish-filing class can also be needed, that helps you tweak your financial budget further.

Possibly the most important steps you can take that you just follow your financial budget and ask for your financial future is always to understand where your dollars goes. Are you going to not just in make your budget, but to make use of the discipline imperative that you follow your financial budget. It’s Okay to produce changes since the priorities change, as extended whenever you bear in mind that you simply have only a good deal money to utilize. This may mean sacrificing in a single place to save for something want in another.

Saving

Whenever you file bankruptcy , you will not access credit for some time, which may be challenging. For this reason it is so important to focus on accumulating your money. That way, you will have some cash reserve for emergencies, as opposed to unintentionally entering debt again. In case you lead to occasions that you simply owe round the medical expense, for instance, utilize the creditor to discover a repayment schedule, as opposed to counting on charge cards.

After you have some cash in position to consider proper proper proper care of emergencies, you can assume control in the finances further by saving for important purchases or expenses. You’ll costs nothing to dream and plan with no worries of debt, setup dreams have to be delayed somewhat. Through an objective inside your ideas, it might be easier to avoid small impulse purchases.

Future Planning

Indebted is effective in reducing your freedom to reside in the existence you have to. Instead of deciding where your dollars goes and exactly how it’s spent, you are associated with debt payments. Bankruptcy can put an finish with this particular stress and supply a totally new start. Exercising of rebuilding your credit and living within a strict budget may benefit you on your existence.